| Bio/Wiki | |

|---|---|

| Full Name | Harshad Shantilal Mehta [1]The Quint |

| Names Earned | The Big Bull & The Amitabh Bachchan of Stock Market [2]The Quint |

| Profession | Stockbroker |

| Famous For | Masterminding the 1992 Stock Market Scam of over INR 4000 crore rupees |

| Personal Life | |

| Date of Birth | 29 July 1954 (Thursday) |

| Birthplace | Paneli Moti, Rajkot District, Gujarat |

| Date of Death | 31 December 2001 (Monday) |

| Place of Death | Thane Civil Hospital, Mumbai |

| Age (at the time of death) | 47 Years |

| Death Cause | Heart Ailment [3]The Times of India |

| Zodiac sign | Leo |

| Nationality | Indian |

| Hometown | Paneli Moti, Rajkot District, Gujarat |

| School | Holy Cross Senior Secondary School, Raipur, Chhattisgarh |

| College/University | Lala Lajpat Rai College of Commerce and Economics, Mumbai (1976) |

| Educational Qualification | B.Com [4]The Quint |

| Relationships & More | |

| Marital Status (at the time of death) | Married |

| Family | |

| Wife/Spouse | Jyoti Mehta |

| Children | Son– Atur Mehta Daughter– None |

| Parents | Father– Shantilal Mehta (Businessman) Mother– Rasilaben Mehta |

| Siblings | Brother– Sudhir Mehta, Hitesh Mehta & Ashwin Mehta (Advocate) Sister– None   |

Some Lesser Known Facts About Harshad Mehta

- Harshad Mehta, hailing from a Gujarati Jain family, emerged as a stockbroker responsible for orchestrating the infamous 1992 stock market scam, widely regarded as India’s largest-ever financial fraud.

- Harshad’s formative years were spent in Kandivali, a suburb of Mumbai, where his father, Shantilal, operated a small textile business. Eventually, the Mehta family relocated to Raipur in Chhattisgarh, where Harshad completed his schooling. In 1973, he returned to Mumbai, then known as Bombay, to pursue his graduation.

- Following his graduation in 1976, Harshad ventured into various odd jobs for the subsequent eight years. Throughout this period, he took on roles as a cement contractor, hosiery salesman, diamond sorter, insurance clerk, and engaged in numerous other sales-related positions.

- Meanwhile, during his time as an insurance agent at the Bombay office of New India Assurance Company Limited (NIACL), Harshad developed a fascination for the stock market. This led him to leave his position at NIACL in 1981 and become a jobber, bringing clients to stockbroker Prasann Pranjivandas, whom he admired as his mentor in the share market industry.

- In due course, Harshad Mehta joined the Bombay Stock Exchange (BSE) in 1984 and founded his own stock brokerage firm named “GrowMore Research and Asset Management.”

- Harshad had a straightforward approach to conducting business. He would secretly divert a large amount of money from government security markets for a short period, and then invest this money in a select few securities. The amount he invested in purchasing shares was so substantial that it caused the price of those shares to skyrocket and then drop once he sold them. This increase in price would attract more people to invest in the same security, further driving up its value. Harshad would gradually sell off his shares, repay the diverted money to the banks, and pocket the significant profit resulting from the rising security prices. He exploited loopholes in the banking system and executed this strategy on a massive scale. In just one year, he managed to raise the Sensex, which is the index of the Bombay Stock Exchange, from 1000 to 4500. The graph below illustrates the movement of the Bombay Stock Exchange Sensex from 1991 to 1992.

- In his investment portfolio, he diversified across various companies such as Apollo tyres, Reliance, Tata Iron and Steel, BPL, Videocon, and ACC. Remarkably, he orchestrated a significant surge in the share price of ACC Cement, elevating it from Rs 200 to an astonishing Rs 9000 within a mere three-month span, amounting to an extraordinary rise of 4500 percent.

- Harshad experienced an extraordinary surge in his business, reaching such remarkable heights by the end of 1991 that he became known in the media as the “Big Bull” and the “Amitabh Bachchan of the Stock Market.”

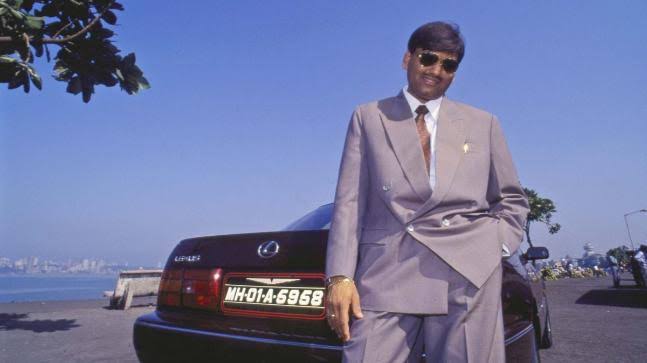

- Living a life that most people could only dream of, he indulged in a lavish lifestyle that encompassed a 15,000 square feet penthouse in Mumbai’s Worli, boasting breathtaking views of the sea. Inside this opulent property, he had the luxury of a mini-golf course and a swimming pool. Additionally, he possessed an impressive collection of high-end automobiles, including a Toyota Lexus worth Rs. 40 lakh, which he used for his travels.

- Harshad Mehta’s smooth sailing came to an abrupt end when journalist Sucheta Dalal became intrigued by his extravagant lifestyle. She delved deeper into the sources of Harshad’s immense wealth of Rs 1000 crores, acquired in an astonishingly short time frame. On 23 April 1992, Sucheta Dalal brought the previously undisclosed truth about Harshad’s manipulation of shares into the public eye through an article in The Times of India. This article detailed how Harshad had orchestrated a financial fraud of Rs 500 crores from the State Bank of India’s treasury. The following year, in 1993, Sucheta Dalal collaborated with Debashis Basu to publish a book titled “The Scam: Who Won, Who Lost, Who Got Away,” which extensively covers the scandal. Sucheta Dalal, the journalist who exposed the Harshad Mehta Scam of 1992, is credited as the author of this captivating book, featuring its intriguing cover.

- After Harshad’s scandal came to light, the banks he had borrowed money from began insisting on repayment, while shareholders rushed to sell their shares. As a result, a significant stock market crash ensued, eradicating trillions of dollars in investors’ wealth within a brief span of two months.

- In November 1992, Harshad Mehta, along with his brothers Sudhir and Ashwin, was apprehended by the CBI for their involvement in the scam. Harshad Mehta faced charges for 72 criminal offences, and numerous banks and institutions filed over 600 criminal action cases against him. Following his arrest by the Mumbai Police, Harshad Mehta was escorted away.

- After being incarcerated for three months, Harshad Mehta, who had enlisted the renowned veteran attorney Ram Jethmalani to handle his case, was granted bail by the High Court of Bombay. Harshad Mehta stood alongside Ram Jethmalani during a press conference.

- Harshad Mehta, upon his release from jail, called for a press conference where he asserted that he had given a bribe of INR 1 crore to the former Prime Minister Narasimha Rao in order to be acquitted from his case. However, the Indian National Congress Party dismissed Harshad Mehta’s accusations, and no evidence was discovered implicating Narasimha Rao in accepting the bribe.

- The Janakiraman Committee was established by the RBI in 1992 to conduct an inquiry into the matter. After a comprehensive investigation, the committee revealed a scam involving INR 4025 crore rupees. To put this amount into perspective in 2020, it would be equivalent to INR 24000 crore. [7]

- Harshad Mehta, along with three others, was found guilty by the High Court of Bombay in September 1999 for their involvement in the Maruti Udyog Ltd fraud case, amounting to Rs 380.97 million. Consequently, Mehta was sentenced to a 5-year prison term.

- While incarcerated at Thane Prison, Harshad Mehta experienced chest pain and was subsequently transferred to Thane Civil Hospital for medical attention. Tragically, on December 31, 2001, Harshad Mehta succumbed to a heart ailment while receiving treatment at the hospital.

- After the exposure of the scam, numerous movies and web series depicting the life of Harshad Mehta have emerged. In 2020, Sony LIV released a Hindi web series titled “Scam 1992 – The Harshad Mehta Story,” which revolves around Harshad’s life.

- Coming soon, a new film titled “The Big Bull” featuring Abhishek Bachchan is set to be released, revolving around the life of Harshad Mehta and the infamous 1992 Indian stock market scam.

- In July 2022, Jyoti, the wife of the late Hanshal Mehta, broke her silence and launched a website in defense of her husband. The website, https://www.harshadmehta.in/, accuses the jail authorities of medical negligence, which led to her husband’s death on December 30, 2001. Jyoti claims that since her husband’s passing, her family has faced unjust “group punishment.” According to the website, on the day of his death, the jail authorities ignored Hanshal’s genuine complaint for four hours after he experienced his first heart attack at around 7 p.m. Despite informing his brother Sudhir about the pain, who was in the adjacent cell, the jail doctors did not have the necessary medicine for a heart attack. Hanshal requested Sorbitrate, a medicine that Jyoti had given him 54 days prior during his arrest, which was stored in the emergency kit in jail custody. This medication kept him alive for approximately four hours. Unfortunately, the jail authorities failed to transfer him to a hospital within this crucial four-hour window, which could have saved his life. Jyoti denounces the practice of “group punishment” and highlights the suspension and violation of her family’s fundamental and constitutional rights over the past 30 years. Despite not being involved in any securities transactions with banks or facing any claims from banks, her entire family has been unjustly subjected to collective punishment.

+ There are no comments

Add yours